WHAT CAN YOU EXPECT TO LEARN?

- Why do we need condo financial statements?

- What is included in my package?

- What is A Condo Balance Sheet?

- What is a 12-month statement?

- What is a budget comparison?

- What does operating income include?

- What do operating expenses include?

- What do financial expenses include?

- What is a general ledger?

- Frequently asked questions about condo financial statements

WHY DO WE NEED CONDO FINANCIAL STATEMENTS?

Condo financial statements provide a record of stewardship used by owners to evaluate directors’ performance. Owners use condominium financial statements to understand the financial performance of their corporation.

How are financial statements used by the condominium board of directors?

Financial statements are used by the condominium board of directors as a decision-making tool to ensure they are using fees collected by owners in the best way possible. Condo financial statements assist in making sure the Condominium Corporation is prepared appropriately for the future. It’s used by a variety of stakeholders to understand the financial health of the condominium corporation.

What third parties use condo financial statements?

- condo managers

- potential purchasers

- real estate lawyers

- reserve fund study consultants

- trade creditors

- mortgagees

- commercial lending institutions

- government agencies

WHAT IS INCLUDED IN MY FINANCIAL STATEMENT PACKAGE?

Packages are provided monthly to the Board of Directors by a specific date as outlined in the Condo Corporation’s management agreement. Larlyn takes pride in making these tools available 24/7 through larlyncommunity.com

Requirements as per Section 66(2) of the Condo Act:

- a balance sheet

- a statement of general operations

- a statement of changes in a financial position

- statement of reserve fund operations

- prescribed information relating to the reserve fund study and the operation of the reserve fund

- an indication of the aggregate remuneration paid to the directors in that capacity and the aggregate remuneration paid to the officers in that capacity

- the additional statements or information that the regulations made under this Act require

What is provided monthly to the Condo Board of Directors?

- Balance sheet

- 12 Month Income Statement

- Budget Comparison

- General Ledger

- Notes to the Financial Statements

NOTE: The types of tools included in each package vary by the Condo Corporation’s unique needs and depend on what was outlined in the management agreement.

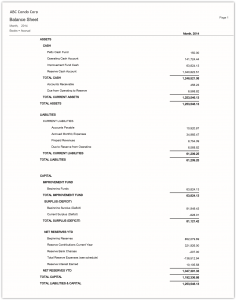

Condo Corporation Balance Sheet

The balance sheet represents a “snapshot” of the financial position of your condominium at a specific point in time for example, as at December 31st .

The condo corporation balance sheet is broken out into three major components:

ASSETS – LIABILITIES = EQUITY

ASSETS ON THE CONDO CORPORATION BALANCE SHEET

Assets are positive, valuable items that include:

- Petty Cash – cash kept on hand and used to make small payments

- Operating Cash Account – funds available for the day to day operations

- Reserve Cash Account – funds available to pay for expenses designated as Reserve Expenses

- Investments – Reserve – accumulated reserve funds that have been invested for an agreed amount of time (not readily available for use)

- Accrued Interest – interest earned to date on above

- Prepaid Expenses – expenses paid in advance, the benefits of which will be consumed in the near term (example: insurance)

- Miscellaneous Accounts Receivable / Sundry Receivables – items earned but cash not yet received (example: laundry income)

- Due from Operating – funds due to the reserve from the operating account but as of reporting date not yet transferred

LIABILITIES ON THE CONDO CORPORATION BALANCE SHEET

Liabilities are negative things owed which include things such as:

- Accounts Payable – invoices received for operating expenses but as of reporting date not yet paid

- Accrued Expenses – expenses that have been incurred for the reporting period but no invoices have been received as of reporting date and are unpaid (example: purchase order issued, goods/services received, invoice not received to be entered as a payable or paid)

- Prepaid Condominium Fees – condominium fees paid to the Corporation in advance of their due date.

- Due to Reserve – funds due to the reserve from the operating account but as of reporting date have not been transferred

EQUITY CAPITAL

Operating Surplus (Deficit)

- Operating Surplus (assets exceed liabilities)

- It is important to remember that this does NOT represent excess cash available. The surplus can be comprised of assets other than cash.

- Operating Deficit (liabilities exceed assets)

- The corporation is not in a strong financial position and owes more than it can take in. The Board of Directors should seriously consider authorizing a special assessment or increasing maintenance fees to strengthen the Corporation’s financial position and not deplete reserves.

- Beginning Surplus (Deficit) – operating surplus or deficit since the inception of the condominium up to and including the previous year-end (often referred to as Retained Earnings)

- Current Surplus (Deficit) – year to date operating results. This amount equals the Net Income under the Year to Date Actual column on the Budget Comparison Statement

Reserve Funds

Reserve funds are the funds available as of reporting date to meet the requirements under the Reserve Fund Study.

- Beginning Reserves – a balance of the Reserve Fund as of the previous year-end.

- Reserve Contributions – funds transferred from the operating account to the reserve account during the current year per the current year budget.

- Reserve Interest – interest earned on the funds held in the reserve bank account(s) and investments for the current year.

WHAT IS A 12-MONTH INCOME STATEMENT?

A 12-month income statement presents actual operating income and expense activity by month across a rolling 12-month period.

NET PROFIT (LOSS) = OPERATING INCOME – OPERATING EXPENSES – FINANCIAL EXPENSES

shown on the Balance Sheet as the Current Surplus (Deficit)

WHAT IS A BUDGET COMPARISON?

A budget comparison presents current MTD Actual (Month To Date Actual) and YTD Actual (Year to Date Actual) operating income and expenses comparing them against MTD Budget (Month to Date Budget) and YTD Budget (Year to Date Budget) which was adopted by the Condominium Board of Directors for the fiscal year.

NET PROFIT (LOSS) = OPERATING INCOME – OPERATING EXPENSES – FINANCIAL EXPENSES

shown on the Balance Sheet as the Current Surplus (Deficit)

WHAT DOES OPERATING INCOME INCLUDE?

(Fund Activity)

- Condominium Revenues

Condominium Revenues are condominium fees assessed to the owners of the units based on the unit factor based on the current year budget.

- Other Income

Other income includes additional sundry income such as fees collected for keys, fobs, cards, laundry income, social club dues, interest on operating funds, NSF fees, etc.

WHAT DO OPERATING EXPENSES INCLUDE?

- Contract Expenses

Contract expenses include cleaning fees, building maintenance, mechanical maintenance, plumbing fees, and grounds maintenance.

- Grounds Maintenance

Grounds maintenance operating expenses include landscaping improvements and snow removal in addition to the contract.

- General Maintenance

General maintenance operating expenses involve cleaning fees, condominium repairs, and improvements in addition to the contract.

- Mechanical Maintenance

Mechanical maintenance operating expenses include elevator maintenance, heating costs, and other mechanical expenses in addition to the contract.

- Amenities & Recreation

Amenities & Recreation operating expenses refer to any costs associated with shared recreational spaces such as the exercise room, pool expenses, etc.

- Employee Wages

Site salaries contribute to operating expenses if the condo corporation has its own staff exclusive to the condominium which equal gross salary less deduction expenses (CPP, EI, etc) and cost of any group benefits if applicable.

- Resources

Resource operating expenses involve utilities including heating, electricity, water, sewer, etc.

- Administration & Professional

Administrative and professional operating costs include insurance, management fees, professional fees (audit, legal), bank charges, photocopying, telephone, office supplies, etc.

WHAT ARE FINANCIAL EXPENSES (Reserve Allocation)?

Additional Tools

A collection of working papers and reconciliations is provided in addition to the Balance Sheet and Income Statements to further explain the numbers presented in those reports.

- Reserve Fund Summary

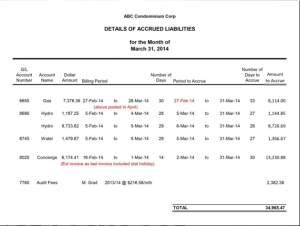

- Accrued Liabilities

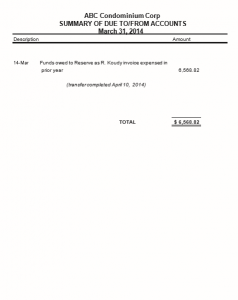

- Due To/From Reserve and Operating Accounts

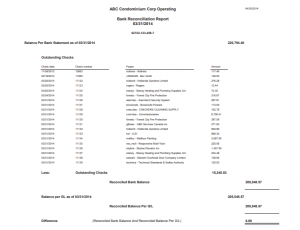

- Bank Reconciliations

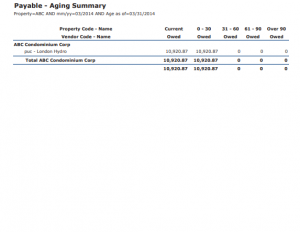

- Aged Payables Summary

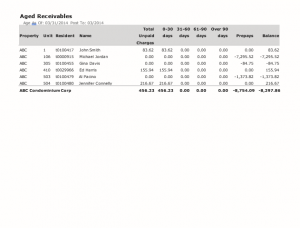

- Aged Accounts Receivable

This list is only a sample of what may be included. Each condo corporation’s requirements are different and the final package contains documents outlined in the management agreement. This typically includes copies of various Bank Statements as well.

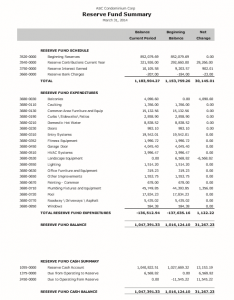

RESERVE FUND SUMMARY

A reserve fund summary is a statement of income and expense for the current reporting period and Year to Date of the Reserve Fund.

Information on future major repairs and replacements is provided by an independent reserve analyst hired by the Condo Corporation estimating how long the components of common property will last and how much it will cost to replace.

Common property is usually broken down into components such as roof, paving, sidewalks, etc.

The cost of replacement per component is estimated along with how much is recommended to put aside to cover these costs.

ACCRUED LIABILITIES

Accrued liabilities are expenses that the condo corporation has incurred but has not yet paid. These do not represent payments that are past due as quite often the invoice has not yet arrived.

DUE TO/FROM RESERVE OPERATING ACCOUNTS

Due to/from reserve operating accounts are essentially internal accounts receivable showing amounts owed from one account to another within the corporation’s ledger.

BANK RECONCILIATIONS

The bank reconciliation report compares the bank records to those tracked in the corporation’s account records to uncover any possible discrepancies.

AGED PAYABLES SUMMARY

The aged payables summary shows the relationship between a corporation’s invoices and its due dates to help see whether it is current on its payments to others.

Aging schedules may also be used by creditors in evaluating whether to lend money.

Comparing aged payables and aged receivables can assist in the prediction of cash flow.

AGED ACCOUNTS RECEIVABLE

The aged accounts receivable is a periodic report that categorizes a corporation’s Accounts Receivable according to the length of time an invoice has been outstanding.

Aging schedules may also be used by auditors in evaluating the value of a corporation’s receivables.

WHAT IS A GENERAL LEDGER?

A general ledger is a complete record of financial transactions over the life of a company, in this case, a condominium corporation, but usually shows only the current period transactions with an opening balance equivalent to the ending balance of the previous period. The general ledger holds account information that is needed to prepare condominium financial statements and includes accounts for assets, liabilities, owners’ equity, revenues, and expenses.

General ledgers are typically used by condo corporations that employ the double-entry bookkeeping method – where each financial transaction is posted twice, as both a debit and a credit, and where each account has two columns. Because a debit in one account is offset by a credit in a different account, the sum of all debits will be equal to the sum of all credits.

NOTES TO THE FINANCIAL STATEMENTS

It is recommended based on the requirements of the Condo Act that the following information be disclosed in the notes to the financial statements:

- The date of registration of the corporation and the total number of the dwelling or other units

- A description of the functions of the corporation including the name, not-for-profit status, and date of registration

- A description of the fund accounting policies adopted by the corporation

- Reserve fund information prescribed by the Act, including a comparison of actual reserve fund allocations and expenses to the planned amounts according to the latest Notice of Future Funding of the Reserve Fund issued to owners

- Details of any cost-sharing or reciprocal agreements (if not otherwise covered by related party transaction disclosure requirements)

This list is not intended to be exhaustive. Other disclosures may also be required. The board should carefully review the financial statements to ensure that all required disclosures are made.

We hope this helped to clarify the information presented in the monthly Financial Statement Packages and how they can be used as decision-making tools to ensure the condo corporation is using fees collected from owners the best way possible and it is prepared appropriately for the future. As always, your Property Management Team is available to answer your questions as they arise to help you do your job better.

We appreciate your business and value our partnership.

Frequently Asked Questions

There is not an exact number that represents a good amount for an operating account. It will depend on your unique situation. It is important to have a strong understanding of all the expenses that could or may occur throughout the year when preparing your budget. This will ensure that you have enough money to cover all expenses.

Some condo corporations set up a contingency fund. This is a fund that holds money that is available for the condo corporation to use just in case an unexpected expense comes up that is not budgeted for.

Contributions to the reserve fund are generally made monthly. The budget states that you need to contribute a certain amount of money each year. This amount can be broken out into monthly payments for convenience.

Some condo corporations may choose to collect condo fees bi-monthly based on their financial needs but typically condo fees will come in monthly and an allocation of these fees will go to the reserve fund.

The general ledger can be daunting. There is a lot of information and the need for a general ledger may seem irrelevant. We provide general ledgers to give as much detail as possible so that individuals or condo boards have all the information they need if they want to drill down into their finances.

If a condo board has made a unanimous decision that they do not need to see the general ledger we can exclude this from their financial statement package.

A special assessment occurs when you have an unforeseen expense and you simply do not have enough money to cover it. In the case where a special assessment needs to take place than everyone in the building takes a pro-rated share of the expense that they have to contribute towards the unforeseen expense.

How much everyone has to pay generally is based on the declaration of the condo corporation.

The property manager will prepare the annual budget for the condominium board to review and approve. The property manager will work alongside their accountants and the property manager’s regional manager to make the most accurate annual budget they can.

The condominium board will make decisions such as if condo fees need to be raised or if certain expenses should be eliminated from the annual budget that the property manager has presented to keep the condo corporation in good financial heal

Generally, utility bills are received monthly. There may be times however that when the financial statement is being prepared, we do not physically have the bill in hand. If the bill is available at the time the statement is created then it becomes a payable. If the bill has not been received yet than an estimated amount of the bill will be stated as an accrual.

In a situation where a bill is paid out of the reserve account when it really should have been paid out the operating account, you will set up a due to from. In this case, you have to make a transfer from the operating account to reserve to cover that amount. This can be done by cutting a cheque from operating to the reserve or depending on the bank we can do electronic transfer and move the money over to the correct account.

6 months from the yearend condo corporations are required to hold an AGM. If there is no AGM set the goal is to have all the yearend financial statements sent to an auditor at the three-month mark and this will give the auditor enough time to prepare the audited statements, sign off on them, address any issues and get them out to the board so they can host an AGM properly.

When you are preparing your budget for the next year you have to allocate enough revenue not only to cover your expenses for the year but to make up the deficit so you are even at zero or in a surplus. This can be done but cutting unnecessary expenses or raising condo fees for residents.

Approximately every 5 years a reserve fund study should be conducted to verify that from the previous study you are on track as to where you need to be or if there have been any big changes since the last reserve fund study.